SASKATCHEWAN AMENDS ITS SECURITIES ACT TO GIVE AN INDEPENDENT DISPUTE RESOLUTION SERVICE (e.g., OBSI) BINDING DECISION-MAKING POWERS OF UP TO $1 MILLION

The Saskatchewan Government has given royal assent to Bill 150 and proclaimed into force The Securities (Saskatchewan Investors Protection) Amendment Act, 2023 (the SK Amendments). The SK Amendments represent a significant legislative effort by the Government of Saskatchewan to enhance investor protection within the province.

Some industry participants are concerned that the Government of Saskatchewan has jumped the gun and done this in advance of the current proposal by the Canadian Securities Administrators (CSA) for setting out a similar national harmonized regime to give an independent dispute resolution service (IDRS) binding decision-making powers under proposed changes to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (the CSA Proposal).

- See CSA Proposal at: https://www.osc.ca/sites/default/files/2023-11/csa_20231130_31-103_proposed-amendments.pdf

- See comment letters to the CSA Proposal at: https://www.osc.ca/en/securities-law/instruments-rules-policies/3/31-103/csa-notice-and-request-comment-registered-firm-requirements-pertaining-independent-dispute/comment-letters

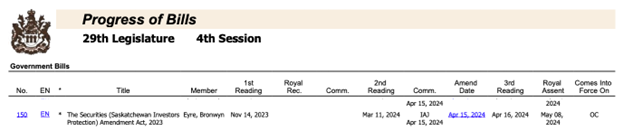

Bill 150 was given First Reading on November 14, 2023, and received Royal Asset on May 8, 2024. The progress of Bill 150 can be seen below.

- You can access a copy of Bill 150 at: https://publications.saskatchewan.ca/#/products/122423

SELECT PROVISIONS OF THE SK AMENDMENTS

Highlights of select provisions of the SK Amendments are set out below.

- Designation of an IDRS

The Saskatchewan Financial and Consumer Affairs Authority (the FCAA) has the power to designate an IDRS which means, subject to the regulations, a not-for-profit company that: (a) provides independent and impartial third-party dispute resolution services outside a court proceeding; and (b) meets any other requirements established by the FCAA.

- The Arbitration Act, 1992 Not Applicable

The Arbitration Act, 1992 (Saskatchewan) does not apply to proceedings conducted by a designated IDRS.

- Applicable Standards and Process

An IDRS has the authority to implement any standards, processes, and procedures it deems necessary to:

- ensure a fair dispute resolution process and outcome based on the specific circumstances of each complaint;

- facilitate the efficient resolution of each complaint; and

- present the dispute resolution process and outcome in an appropriate format and language tailored to the circumstances of each complaint.

The service must use only those standards, processes, and procedures required to meet these objectives. Additionally, it may include additional parties to an existing complaint if it considers such inclusion to be appropriate and fair.

The language above is what the CSA refers to as its “essential process test” in the CSA Proposal.

- Authority to Issue Binding Non-Appealable Orders for up to

The Saskatchewan Government has given royal assent to Bill 150 and proclaimed into force The Securities (Saskatchewan Investors Protection) Amendment Act, 2023 (the SK Amendments). The SK Amendments represent a significant legislative effort by the Government of Saskatchewan to enhance investor protection within the province.

Some industry participants are concerned that the Government of Saskatchewan has jumped the gun and done this in advance of the current proposal by the Canadian Securities Administrators (CSA) for setting out a similar national harmonized regime to give an independent dispute resolution service (IDRS) binding decision-making powers under proposed changes to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (the CSA Proposal).

- See CSA Proposal at: https://www.osc.ca/sites/default/files/2023-11/csa_20231130_31-103_proposed-amendments.pdf

- See comment letters to the CSA Proposal at: https://www.osc.ca/en/securities-law/instruments-rules-policies/3/31-103/csa-notice-and-request-comment-registered-firm-requirements-pertaining-independent-dispute/comment-letters

Bill 150 was given First Reading on November 14, 2023, and received Royal Asset on May 8, 2024. The progress of Bill 150 can be seen below.

- You can access a copy of Bill 150 at: https://publications.saskatchewan.ca/#/products/122423

SELECT PROVISIONS OF THE SK AMENDMENTS

Highlights of select provisions of the SK Amendments are set out below.

- Designation of an IDRS

The Saskatchewan Financial and Consumer Affairs Authority (the FCAA) has the power to designate an IDRS which means, subject to the regulations, a not-for-profit company that: (a) provides independent and impartial third-party dispute resolution services outside a court proceeding; and (b) meets any other requirements established by the FCAA.

- The Arbitration Act, 1992 Not Applicable

The Arbitration Act, 1992 (Saskatchewan) does not apply to proceedings conducted by a designated IDRS.

- Applicable Standards and Process

An IDRS has the authority to implement any standards, processes, and procedures it deems necessary to:

- ensure a fair dispute resolution process and outcome based on the specific circumstances of each complaint;

- facilitate the efficient resolution of each complaint; and

- present the dispute resolution process and outcome in an appropriate format and language tailored to the circumstances of each complaint.

The service must use only those standards, processes, and procedures required to meet these objectives. Additionally, it may include additional parties to an existing complaint if it considers such inclusion to be appropriate and fair.

The language above is what the CSA refers to as its “essential process test” in the CSA Proposal.

- Authority to Issue Binding Non-Appealable Orders for up to $1 million

An IDRS has the authority to issue various orders to registrants if it deems it fair based on the circumstances of the complaint. These orders can include:

- requiring a registrant to review, rectify, mitigate, or change the conduct that is being complained about or its consequences;

- compel a registrant to provide reasons or explanations for the conduct, change practices related to the conduct, and correct information provided to federal and provincial tax authorities;

- order the correction of a credit rating, the forgiveness or variation of a debt, the release of assets held for a debt, the repayment, waiver, or variation of fees or other amounts owed, the reinstatement, variation, rectification, or setting aside of a contract, and meeting claims under an insurance policy; and

- in cases involving privacy concerns, an IDRS can order the correction, addition, or deletion of information related to the complainant to prevent further privacy violations.

In addition to these corrective actions, the IDRS can mandate that a registrant compensate a complainant for issues related to the complaint. These orders are binding on all parties involved in the complaint, ensuring that the resolutions are enforced. The SK Amendment also changed the complaint threshold for monetary compensation from $100,000 to $1,000,000.

Orders issued by the designated IDRS can be filed with the Court of King’s Bench by either the service itself or the complainant. Once filed, these orders can be enforced in the same manner as any court order or judgment. Importantly, the orders made by the service are final and cannot be appealed, providing a decisive and authoritative resolution to the disputes.

IMPLICATIONS OF THE SK AMENDMENTS

The SK Amendments precede the broader implementation of similar reforms anticipated under the CSA Proposal. Saskatchewan’s early adoption will be seen by some as pre-emptive and jumping the gun ahead of the completed review of the CSA Proposal. It is not clear why the Saskatchewan Government would not wait for the completion of the CSA Proposal which is currently being reviewed by the FCAA.

The SK Amendment does not necessarily create a harmonized approach and could create a patchwork of different dispute resolution frameworks across Canada which is not in the public interest. For example, the most glaring concern for registrants of the SK Amendments is increasing the complaint limit for monetary compensation from $100,000 to $1,000,000 when the CSA is only considering a maximum of $350,000.

The regulations to the SK Amendments have not yet been promulgated and it is hoped that the FCAA will work with the CSA members to provide a harmonized approach.

The PCMA opposes the CSA Proposal as it believes it is not fair and balanced and instead one-sided in favour of complainants. The PCMA has its comment letter and many articles about its thoughts and perspective that can be viewed on the PCMA’s advocacy website called Fair and Balanced Regulations at: https://fairandbalancedregs.com/.

The Saskatchewan Government has given royal assent to Bill 150 and proclaimed into force The Securities (Saskatchewan Investors Protection) Amendment Act, 2023 (the SK Amendments). The SK Amendments represent a significant legislative effort by the Government of Saskatchewan to enhance investor protection within the province.

Some industry participants are concerned that the Government of Saskatchewan has jumped the gun and done this in advance of the current proposal by the Canadian Securities Administrators (CSA) for setting out a similar national harmonized regime to give an independent dispute resolution service (IDRS) binding decision-making powers under proposed changes to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (the CSA Proposal).

- See CSA Proposal at: https://www.osc.ca/sites/default/files/2023-11/csa_20231130_31-103_proposed-amendments.pdf

- See comment letters to the CSA Proposal at: https://www.osc.ca/en/securities-law/instruments-rules-policies/3/31-103/csa-notice-and-request-comment-registered-firm-requirements-pertaining-independent-dispute/comment-letters

Bill 150 was given First Reading on November 14, 2023, and received Royal Asset on May 8, 2024. The progress of Bill 150 can be seen below.

- You can access a copy of Bill 150 at: https://publications.saskatchewan.ca/#/products/122423

SELECT PROVISIONS OF THE SK AMENDMENTS

Highlights of select provisions of the SK Amendments are set out below.

- Designation of an IDRS

The Saskatchewan Financial and Consumer Affairs Authority (the FCAA) has the power to designate an IDRS which means, subject to the regulations, a not-for-profit company that: (a) provides independent and impartial third-party dispute resolution services outside a court proceeding; and (b) meets any other requirements established by the FCAA.

- The Arbitration Act, 1992 Not Applicable

The Arbitration Act, 1992 (Saskatchewan) does not apply to proceedings conducted by a designated IDRS.

- Applicable Standards and Process

An IDRS has the authority to implement any standards, processes, and procedures it deems necessary to:

- ensure a fair dispute resolution process and outcome based on the specific circumstances of each complaint;

- facilitate the efficient resolution of each complaint; and

- present the dispute resolution process and outcome in an appropriate format and language tailored to the circumstances of each complaint.

The service must use only those standards, processes, and procedures required to meet these objectives. Additionally, it may include additional parties to an existing complaint if it considers such inclusion to be appropriate and fair.

The language above is what the CSA refers to as its “essential process test” in the CSA Proposal.

- Authority to Issue Binding Non-Appealable Orders for up to $1 million

An IDRS has the authority to issue various orders to registrants if it deems it fair based on the circumstances of the complaint. These orders can include:

- requiring a registrant to review, rectify, mitigate, or change the conduct that is being complained about or its consequences;

- compel a registrant to provide reasons or explanations for the conduct, change practices related to the conduct, and correct information provided to federal and provincial tax authorities;

- order the correction of a credit rating, the forgiveness or variation of a debt, the release of assets held for a debt, the repayment, waiver, or variation of fees or other amounts owed, the reinstatement, variation, rectification, or setting aside of a contract, and meeting claims under an insurance policy; and

- in cases involving privacy concerns, an IDRS can order the correction, addition, or deletion of information related to the complainant to prevent further privacy violations.

In addition to these corrective actions, the IDRS can mandate that a registrant compensate a complainant for issues related to the complaint. These orders are binding on all parties involved in the complaint, ensuring that the resolutions are enforced. The SK Amendment also changed the complaint threshold for monetary compensation from $100,000 to $1,000,000.

Orders issued by the designated IDRS can be filed with the Court of King’s Bench by either the service itself or the complainant. Once filed, these orders can be enforced in the same manner as any court order or judgment. Importantly, the orders made by the service are final and cannot be appealed, providing a decisive and authoritative resolution to the disputes.

IMPLICATIONS OF THE SK AMENDMENTS

The SK Amendments precede the broader implementation of similar reforms anticipated under the CSA Proposal. Saskatchewan’s early adoption will be seen by some as pre-emptive and jumping the gun ahead of the completed review of the CSA Proposal. It is not clear why the Saskatchewan Government would not wait for the completion of the CSA Proposal which is currently being reviewed by the FCAA.

The SK Amendment does not necessarily create a harmonized approach and could create a patchwork of different dispute resolution frameworks across Canada which is not in the public interest. For example, the most glaring concern for registrants of the SK Amendments is increasing the complaint limit for monetary compensation from $100,000 to $1,000,000 when the CSA is only considering a maximum of $350,000.

The regulations to the SK Amendments have not yet been promulgated and it is hoped that the FCAA will work with the CSA members to provide a harmonized approach.

The PCMA opposes the CSA Proposal as it believes it is not fair and balanced and instead one-sided in favour of complainants. The PCMA has its comment letter and many articles about its thoughts and perspective that can be viewed on the PCMA’s advocacy website called Fair and Balanced Regulations at: https://fairandbalancedregs.com/.

million

An IDRS has the authority to issue various orders to registrants if it deems it fair based on the circumstances of the complaint. These orders can include:

- requiring a registrant to review, rectify, mitigate, or change the conduct that is being complained about or its consequences;

- compel a registrant to provide reasons or explanations for the conduct, change practices related to the conduct, and correct information provided to federal and provincial tax authorities;

- order the correction of a credit rating, the forgiveness or variation of a debt, the release of assets held for a debt, the repayment, waiver, or variation of fees or other amounts owed, the reinstatement, variation, rectification, or setting aside of a contract, and meeting claims under an insurance policy; and

- in cases involving privacy concerns, an IDRS can order the correction, addition, or deletion of information related to the complainant to prevent further privacy violations.

In addition to these corrective actions, the IDRS can mandate that a registrant compensate a complainant for issues related to the complaint. These orders are binding on all parties involved in the complaint, ensuring that the resolutions are enforced. The SK Amendment also changed the complaint threshold for monetary compensation from 0,000 to

The Saskatchewan Government has given royal assent to Bill 150 and proclaimed into force The Securities (Saskatchewan Investors Protection) Amendment Act, 2023 (the SK Amendments). The SK Amendments represent a significant legislative effort by the Government of Saskatchewan to enhance investor protection within the province.

Some industry participants are concerned that the Government of Saskatchewan has jumped the gun and done this in advance of the current proposal by the Canadian Securities Administrators (CSA) for setting out a similar national harmonized regime to give an independent dispute resolution service (IDRS) binding decision-making powers under proposed changes to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (the CSA Proposal).

- See CSA Proposal at: https://www.osc.ca/sites/default/files/2023-11/csa_20231130_31-103_proposed-amendments.pdf

- See comment letters to the CSA Proposal at: https://www.osc.ca/en/securities-law/instruments-rules-policies/3/31-103/csa-notice-and-request-comment-registered-firm-requirements-pertaining-independent-dispute/comment-letters

Bill 150 was given First Reading on November 14, 2023, and received Royal Asset on May 8, 2024. The progress of Bill 150 can be seen below.

- You can access a copy of Bill 150 at: https://publications.saskatchewan.ca/#/products/122423

SELECT PROVISIONS OF THE SK AMENDMENTS

Highlights of select provisions of the SK Amendments are set out below.

- Designation of an IDRS

The Saskatchewan Financial and Consumer Affairs Authority (the FCAA) has the power to designate an IDRS which means, subject to the regulations, a not-for-profit company that: (a) provides independent and impartial third-party dispute resolution services outside a court proceeding; and (b) meets any other requirements established by the FCAA.

- The Arbitration Act, 1992 Not Applicable

The Arbitration Act, 1992 (Saskatchewan) does not apply to proceedings conducted by a designated IDRS.

- Applicable Standards and Process

An IDRS has the authority to implement any standards, processes, and procedures it deems necessary to:

- ensure a fair dispute resolution process and outcome based on the specific circumstances of each complaint;

- facilitate the efficient resolution of each complaint; and

- present the dispute resolution process and outcome in an appropriate format and language tailored to the circumstances of each complaint.

The service must use only those standards, processes, and procedures required to meet these objectives. Additionally, it may include additional parties to an existing complaint if it considers such inclusion to be appropriate and fair.

The language above is what the CSA refers to as its “essential process test” in the CSA Proposal.

- Authority to Issue Binding Non-Appealable Orders for up to