CSA Data Inadequately Explains A Power Imbalance Between Complainants And Registrants In OBSI’s Dispute Resolution Process

The Private Capital Markets Association of Canada (PCMA) supports fair and balanced regulation. This article is part of a PCMA series commenting on the Canadian Securities Administrators’ (CSA) proposal to give the Ombudsman for Banking Services and Investments (OBSI) binding decision-making powers of up to $350,000 (the Proposed Amendments) under proposed amendments to National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (NI 31-103).

In the Proposed Amendments, the CSA criticizes the current dispute resolution process for creating a “power imbalance” between complainants and registered firms that favours registered firms. The CSA states that registered firms often have greater resources and specialized knowledge about the substance of a complaint. The PCMA disagrees with the CSA’s position that a power imbalance exists, particularly with certain types of investors. Specifically, accredited investors and permitted clients do not need the protection of binding arbitration by an ombudservice due to their wealth and sophistication, the basis of the exemptions given to them under applicable securities law. This article explains why the PCMA does not believe such a power imbalance between complainants and registrants exist in OBSI’s dispute resolution process.

No Power Imbalance Based on Education

The PCMA acknowledges that a firm may have more specialized knowledge as a registrant, however, the Proposed Amendments suggests complainants lack sophistication. A complainant may not be as unsophisticated as one would assume based on the CSA’s comments of a power imbalance.

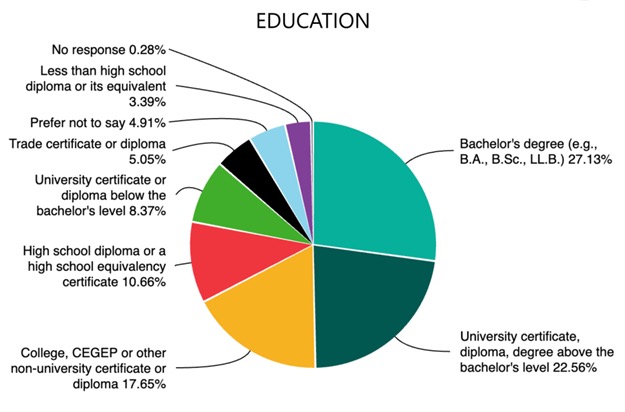

Based on a review of OBSI’ Demographics website page, 50% of investment industry complainants had a Bachelor’s Degree or higher (e.g., university certificate, diploma or degree above a Bachelor Degree), as set out in the pie chart below.[1] This increases to 67% when including those complainants who have a college, CEGEP or other non-university certificate or diploma.

No Power Imbalance with Accredited Investors

It is not clear why the CSA believes that accredited investors have a power imbalance relative to a registered firm. By definition, accredited investors include wealthy investors who satisfy the accredited investor exemption criteria (the AI Exemption), as set out in section 2.3 of National Instrument 45-106 Prospectus Exemptions (NI 45-106).

Under NI 45-106, accredited investors include individuals who meet certain income or asset thresholds, such as having:

- net financial assets of at least $1 million;

- net assets of at least $5 million; and

- net income over $200,000 ($300,000 if combined with a spouse) in each of the last 2 years.

(Sections 1.1(j), (j.1), (k), and (l) of the AI Exemption)

Accredited investors also include:

- institutional investors such as banks, pension funds, government bodies and agencies and registered dealers/advisers (sections 1.1(a) to (i) of the AI Exemption); and

- other entities like corporate issuers, trusts, or investment funds (sections 1.1 (m), (p), (t), (u), and (w) of the AI Exemption).

The policy rationale for the AI Exemption is based on investor wealth and sophistication and that is why they do not require the protections of the prospectus requirement. The above individuals and entities are wealthy and/or sophisticated and have the resources to adequately represent themselves in any dispute with a registered firm. Accordingly, they do not have a power imbalance, as assumed by the CSA. The PCMA believes accredited investors should be excluded from binding arbitration as recommended by the Proposed Amendments as they can adequately negotiate their complaints with a firm, take legal action or otherwise.

No Power Imbalance with Permitted Clients

The CSA has not carved out binding dispute resolution for permitted clients. As defined in s. 1.1 of NI 31-103, a permitted client is a subset of accredited investors which includes sophisticated investors such as major financial institutions, government bodies and agencies, registered advisers and dealers, pension funds, entities with substantial net assets (at least $25 million), and individuals or entities that own net financial assets exceeding $5 million. NI 31-103 waives several safeguards for permitted clients as a matter of public policy since they have sufficient wealth or knowledge that they do not require the protections available under applicable securities law.

Under section 13.3 of NI 31-103, permitted clients may waive their right to have a registrant determine that a trade is suitable. To rely on this exemption, the registrant must determine that a client is a permitted client at the time the client waives their right to suitability.

Based on the foregoing, an even stronger case can be made that permitted clients are wealthy, sophisticated investors and have the resources to adequately represent themselves in any dispute with a registered firm. Accordingly, accredited investors and permitted clients do not have a power imbalance, as stated by the CSA.

The PCMA believes accredited investors and permitted clients should be excluded from binding arbitration as recommended by the Proposed Amendments as they can adequately negotiate their complaints with a firm, take legal action or otherwise.

Lower Case Settlement Amounts are Not Evidence of a Power Imbalance

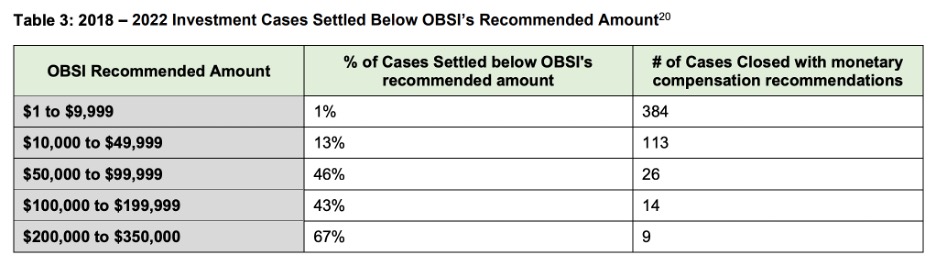

As part of the evidence of a power imbalance between complainants and a registered firm, the CSA included Table 3 below in the Proposed Amendments. Table 3 examines the percentage of cases that settled below OBSI’s recommended amount and the number of cases that closed with monetary compensation recommended by OBSI. The inference is that if a case settles below OBSI’s recommended amount, there is a power imbalance.

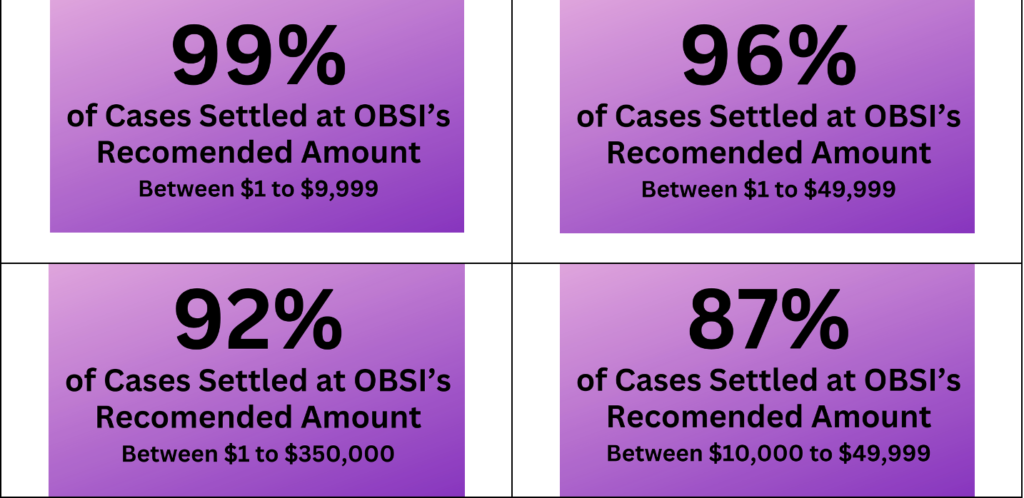

The CSA claims Table 3 is evidence of registered firms negotiating down the compensation paid to complainants and in part why binding decision-making powers should be granted to OBSI. Using the numbers in Table 3, the number and percentage of cases settled with the compensation recommended by OBSI can be extrapolated. The PCMA created the table below comparing settlements made at the amount recommended by OBSI and those settled at a lower amount.

| OBSI Recommended Amount | Cases Settled below OBSI’s recommended amount | Cases Settled at OBSI’s recommended amount | Total Cases Settled | ||

| Percent | Number | Percent | Number | Number | |

| $1 to $9,999 | 1% | 4 | 99% | 380 | 384 |

| $10,000 to $49,999 | 13% | 15 | 87% | 98 | 113 |

| $50,000 to $99,000 | 46% | 12 | 54% | 14 | 26 |

| $100,000 to $199,999 | 43% | 6 | 57% | 8 | 14 |

| $200,000 to $350,000 | 67% | 6 | 33% | 3 | 9 |

| $1 to 49,999 | 4% | 19 | 96% | 478 | 497 |

| $1 to 350,000 | 8% | 43 | 92% | 503 | 546 |

The comparative data above does not support the CSA’s view that there is a power imbalance. In total, only 8% of cases settle below OBSI’s recommended amount and only 4% when looking at the majority of settlements, which have compensation amounts between $1 and $49,999.

The data suggests that the higher the settlement amount, the more registrants disagree with the proposed settlement. The PCMA would like to understand the factors that lead to this difference as this may identify that registrants have concerns with, among other things, OBSI’s loss calculation methodology for private market investments, or OBSI’s complaint review process. Rather than creating a new framework when 92% of the cases settle at the amount recommended by OBSI, the CSA and OBSI should determine what are the factors in these 43 or 8% of cases that led registrants to disagree with the amount recommended by OBSI.

Additionally, when a proposed settlement exceeds $50,000, it implies that the initial investment was substantially more because settlement figures typically represent the discrepancy between the actual returns received by a client and what OBSI determines they were entitled to, not the full investment amount. If the investment amounts are larger, this may suggest that in these cases the investors may be accredited investors or permitted clients and therefore do not need the same level of protection as retail investors.

The PCMA is concerned that the Proposed Amendments seeks to make a radical change without sufficient data to support the need for a change.

CSA Assumes OBSI’s Recommended Settlement Amounts Are Correct

The CSA reference to a power imbalance also assumes that OBSI’s settlement calculations are correct. OBSI does not have any publicly disclosed loss calculation methodology for valuing private market investments other than a general statement on its website.[2] Transparency in the methodology is crucial for ensuring fairness and consistency. Without a detailed and publicly available methodology, there is a risk that OBSI’s calculations may not be correct and could be seen as arbitrary.

The PCMA believes OBSI must fully disclose and provide a detailed loss calculation methodology for valuing private market investments, including all material factors and assumptions OBSI intends to rely on.

Within the private markets, EMDs may not have a current market value for securities of an issuer since it is not determinable, or the issuer will not provide such information to an EMD or other registrant. Moreover, if securities of an issuer are no longer in distribution by an EMD, obtaining such information may be challenging.

When market value is not determinable or unavailable, the PCMA is aware of instances where OBSI is requiring EMDs to buy back the entire private market investment from the complainant plus opportunity loss/cost. This approach represents a remedy of convenience when OBSI cannot determine the amount. The PCMA perceives this as a convenient solution for OBSI rather than a fair assessment of the actual value of the investment and/or the loss incurred. This could also be unfair to EMDs if the actual value is not as negative as presumed.

Requiring an EMD to buy back the entire investment from the complainant may work for larger EMDs but could render a smaller EMD insolvent. While there may be an assumption that the EMD will receive the ultimate return on the investment once realized, there is a payout required to be made to the complainant in the interim; this means a reduction in current working capital which could be beyond the minimum amount required under NI 31-103 (for EMDs this is between $50,000 to $100,000 depending on the firm’s registration categories).

For clarity, some registrants believe there is an innate OBSI bias towards declaring an entire exempt market investment unsuitable since the market value cannot be readily determined by OBSI. However, OBSI could determine a reduced investment amount may be suitable if it had a loss calculation methodology for private market investments. PCMA members have experienced OBSI asserting that not $1.00 of a private market investment is suitable for a particular investor. This is a faulty approach to suitability assessments and not in alignment with the minimum amounts allowed for retail investors under the Offering Memorandum exemption in NI 45-106.[3]

Confusing Evidence as CSA States OBSI’s Current Approach Addresses Any Power Imbalance

The PCMA further questions the alleged power imbalance when the Proposed Amendments state, among other things, that:

- “The inquisitorial approach gives OBSI procedural flexibility to address the potential power imbalance between complainants and firms when determining the issues in dispute and gathering information.”

- “As is currently the case under OBSI’s processes, the investigation and recommendation stage would be concerned with resolving a dispute fairly and addressing power imbalances which may exist between the parties because of potentially limited resources or lack of sophistication on the part of the complainant, as compared to the firm.”

The PCMA notes that the CSA on the one hand cites a power imbalance based on the number of cases closed below OBSI’s recommended amount as grounds for giving OBSI binding decision-making powers, while also stating that OBSI’s current procedural flexibility adequately addresses such matters. The PCMA finds such statements contradictory and does not believe they support the CSA’s evidence.

Conclusion

The PCMA submits that the CSA has not made a case for an alleged power imbalance between complainants and registered firms based on the evidence set out in the Proposed Amendments and discussed above. The numbers suggest that for lower settlement amounts (less than $50,000), almost all cases settle at OBSI’s recommended amount. Lower settlement amounts suggest complainants may have smaller investments and may have a power imbalance. Despite this imbalance, 96% are settled at OBSI’s recommended amount which leads the PCMA to question why a change to binding arbitration is required.

The PCMA believes that accredited investors and permitted clients do not need the protections of an ombudservice due to their wealth and sophistication which forms the basis of these exemptions under applicable securities law. The number of settlements below OBSI’s recommended amount is significantly higher for settlements above $50,000. A higher settlement amount indicates a larger investment which may indicate the investment was made by a person with more financial means and so not in need of increased protection.

Additional Information:

- Link to PCMA’s Comment Letter to CSA Against Giving OBSI Binding Decision-Making Powers: https://www.osc.ca/sites/default/files/2024-02/com_20240228_31-103_hansonr.pdf

- Other PCMA Articles on this Topic: For more information about this Article and similar articles, please see the PCMA’s dedicated website to this topic at: www.fairandbalancedregs.com

- Link to Full CSA Proposal to Give OBSI Binding Decision-Making Powers: https://www.osc.ca/sites/default/files/2023-11/csa_20231130_31-103_proposed-amendments.pdf

[1] See Education data from OBSI’s Demographics website for the date range 11/1/2016 – 10/31/2023 for Investments only available on OBSI’s website at: https://www.obsi.ca/en/case-data-insights/demographics.aspx

[2] For OBSI’s exempt market product loss calculation overview, see its website at: https://www.obsi.ca/en/how-we-work/emd-loss-calculation.aspx

[3] Section 2.9 of NI 45-106, in certain jurisdictions, allows non-eligible investors to invest up to $10,000 every 12 months without the advice of a registrant. A non-eligible investor is the opposite of an eligible investor as defined in Section 1.1 of NI 45-106, with financial criteria lower than an accredited investor such as net income of $75,000 alone or $125,000 with a spouse and net assets of $400,000 alone or with a spouse. https://www.bcsc.bc.ca/-/media/PWS/New-Resources/Securities-Law/Instruments-and-Policies/Policy-4/45106-NI-September-13-2023.pdf?dt=20230913152514